FEDERAL ACTION ALERT (as of 12/12/2022):

Time is running out... Contact Senator McConnell and tell him Congress must enact disaster relief legislation that restores and expands expired charitable giving and employment tax incentives. Every day there is a delay is one less day you can communicate the incentive to your donors to encourage year-end donations! The coming hours are critical.

Step 1: Email Senator McConnell (please copy and paste this text below):

Dear Leader McConnell:

Charitable nonprofits are still reeling from years of significantly increased demand for services and unstable or declining resources. And nonprofits in Kentucky, especially those providing disaster relief, have been hit particularly hard.

The charitable giving incentives enacted by Congress, and in particular the Universal Charitable Deduction, helped nonprofits meet those needs and maintain services.

We ask that you immediately restore and extend the charitable giving incentives through 2023 to provide support to nonprofits now while giving Congress time to consider permanent solutions. Nonprofits need donations now and they need time to communicate this incentive to their donors to benefit from their generosity before year end.

Sincerely,

(Your Name)

(Your Organization)

Step 2: Have a few more minutes? Please email the same message to all members of Kentucky’s federal delegation.

- Email Senator Paul

- Email Congressman Barr

- Email Congressman Comer

- Email Congressman Guthrie

- Email Congressman Massie

- Email Congressman Rogers

- Email Congressman Yarmuth

Step 3: Still on Twitter? Tweet this message above or Retweet from @kynonprofits - use the tag #Relief4Charities and tag our federal delegation:

- @senatemajldr, Senate Minority Leader

- @RepJohnYarmuth, Chairman House Budget Committee

- @RandPaul

- @RepAndyBarr

- @JamesComer

- @RepGuthrie

- @RepThomasMassie

- @RepHalRogers

The stakes are high and Congress has a very limited window to enact urgently needed relief - please ACT NOW! Nonprofits need relief to overcome the challenges of workforce shortages caused by the pandemic, sharply increasing demands for services, and the effects of multiple natural disasters around the country. This article from The Hill on 12/10 is an important read: Natural disasters keep coming. So should disaster tax relief.

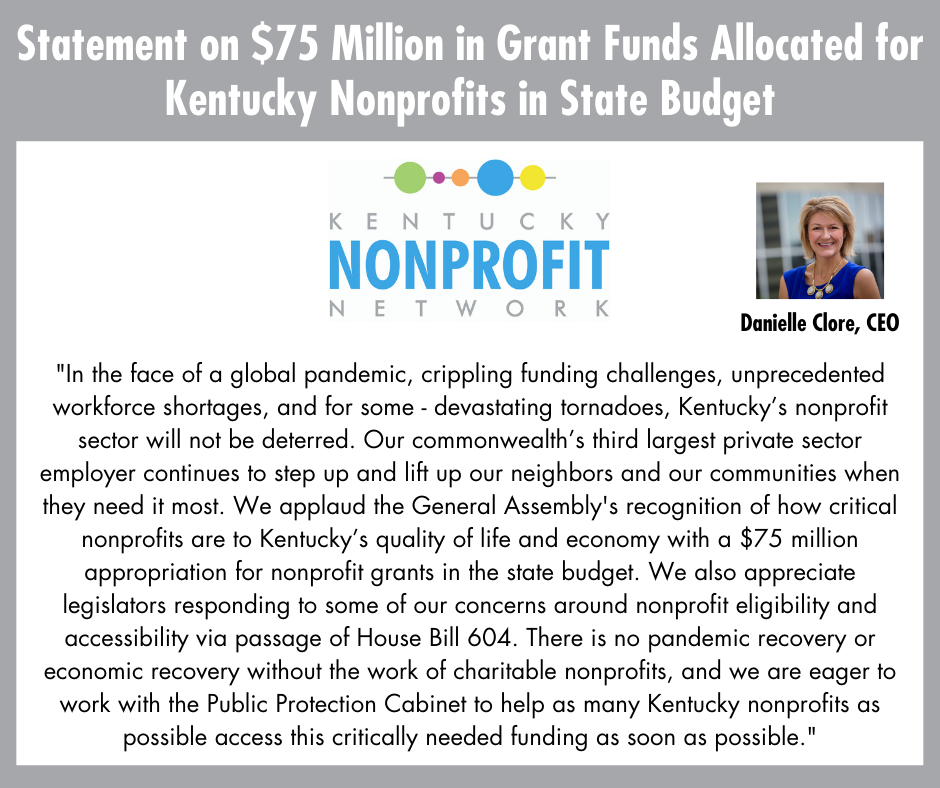

KY's $75 million Nonprofit Relief Grant Program, the Nonprofit Assistance Fund Application Portal is now CLOSED.

- Note: If your nonprofit has not receieved any communication from the Public Protection Cabinet regarding your application, you are encouraged to contact them - visit the Team KY Nonprofit Assistance Fund website for more information.

- Click here to read the REVISED program guidelines (second application window).

- Click here to access the free recording of KNN's 7/21/22 Virtual Town Hall Meeting with the Public Protection Cabinet providing details on the program.

- Click here to watch a free recording of KNN's 8/6/22 Virtual Town Hall Meeting, where we briefly discussed updates on the Nonprofit Assistance Fund, including commonly asked questions.

- Click here to watch a free recording of KNN's 8/18/22 Virtual Town Hall Meeting with the Public Protection Cabinet providing an update on the program.

- Click here to access screenshots of the online application portal (updated 7/29/22)

- Click here to access KNN's Eligibility Checklist (from first application window)

- Click here to access KNN's Application Checklist (updated 7/29/22) Note that as of 11/7/22, the federal aid affadavit is no longer required.

- Click here to access the Public Protections Cabinet's FAQ (updated 7/29/22)

- Click here to access the Nonprofit Assistance Fund website, which includes Program Guidelines and several examples to assist you.

- Click here for KNN's announcement email - 7/22/22

- Find your Senator

- Find your member of the House of Representatives

- Legislative Research Commission website provides links to live-feed coverage, committee schedules and more. You can also follow coverage on the Legislature's YouTube Channel or KET.

2022 Public Policy & Legislative Priorities

- Establish a $75 million Nonprofit Sustainability & Recovery Fund

- Enhance Tax Incentives to Increase Charitable Giving

- Address the Nonprofit Workforce Crisis

Local economic relief for & partnerships with nonprofits:

- Advocate for and provide resources to assist local nonprofits in accessing city and county American Rescue Plan Act or other relief funds.

[Click to read more on this issue.]

Public-private partnerships for the public good: Promote and support executive action or legislation that address systemic problems with nonprofit-government contracting, including streamlining contracts and contracts paying for the full cost of services (outlined in the final recommendation of the Government Contracting Task Force, 11/15/16).

Budgeting and spending to address community needs: Advocate for thoughtful state budget decisions and tax reform that encourage solutions that promote fiscal stability and growth, while ensuring that the workof nonprofits on behalf of the communities and people they serve is sustained and protected.

Tax policy that empowers community solutions through nonprofits:

- Support expanded, enhanced and new tax and other incentives for individuals and businesses, including a universal non-itemizer charitable giving tax deduction, at the federal and state level to encourage individuals to give generously to the work of charitable nonprofits. Actively oppose floors, caps or limits on existing incentives that would harm the sector’s ability to leverage philanthropic support.

[Check out our 2022 request of the KY General Assembly.]

- Oppose the imposition of fees, taxes, and fees on tax-exempt nonprofit organizations.

- Maintain and – where appropriate – expand nonprofit exemptions from paying state and local property, sales and use taxes and from collecting sales and use taxes.

Nonprofit employer rights:

- Support nonprofit employers’ rights to use all tools available to them to keep their employees and constituents safe during the pandemic, including the right to require vaccination and/or testing. Every workplace is different, and decisions regarding vaccines should be left up to employers, as is currently long-standing Kentucky law.

Unemployment relief for nonprofits:

- Advocate for 100% coverage of all COVID-19 related unemployment insurance claims for self-insured/reimbursing nonprofits employers and extension of this coverage in 2022.

- Advocate for federal relief for the state unemployment insurance trust fund, impacting thousands of nonprofit employers contributing to the fund.

Nonprofit advocacy rights and civic engagement:

- Preserve the integrity of charitable nonprofits by supporting the tax-law ban on electioneering and partisan political activities.

- Oppose restrictions on the advocacy rights of charitable nonprofits.

- Support legislation that makes it easier for Kentuckians to vote.

Nonprofit independence and ensuring public trust: Support reasonable and non-burdensome regulations and policies that allow nonprofits to earn and maintain public trust through appropriate transparency. Oppose policies or legislation that impose increased costs, burdens, barriers, limitations, or liabilities on nonprofits – negatively impacting their ability to effectively accomplish their core mission.

Recent Advocacy/Policy Communication & Recordings

- Virtual Press Conference/Town Hall Meeting: Nonprofits Seek Bridge to Sustainability & Recovery; Demonstrate More Than Charity (February 3)

- Virtual Town Hall Meeting Recording - nonprofit legislative priorities (January 6)

- Virtual Press Conference: Workforce Crisis Putting Vulnerable Kentuckians At Risk (January 5)

- Virtual Town Hall Meeting Recording - 2022 Legislative Preview with Governor Andy Beshear (November 2021)

- Virtual Town Hall Meeting Recording - 2022 Legislative Preview with Nonprofit Caucus Members (November 2021)

- ARPA Resources to Assist in Advocating for Local Government Partnerships with Nonprofits